Many Americans are shocked by their 2018 tax refunds.

The Internal Revenue Service is reporting that the average refund is down 17 percent this year as compared to the same time in 2018.

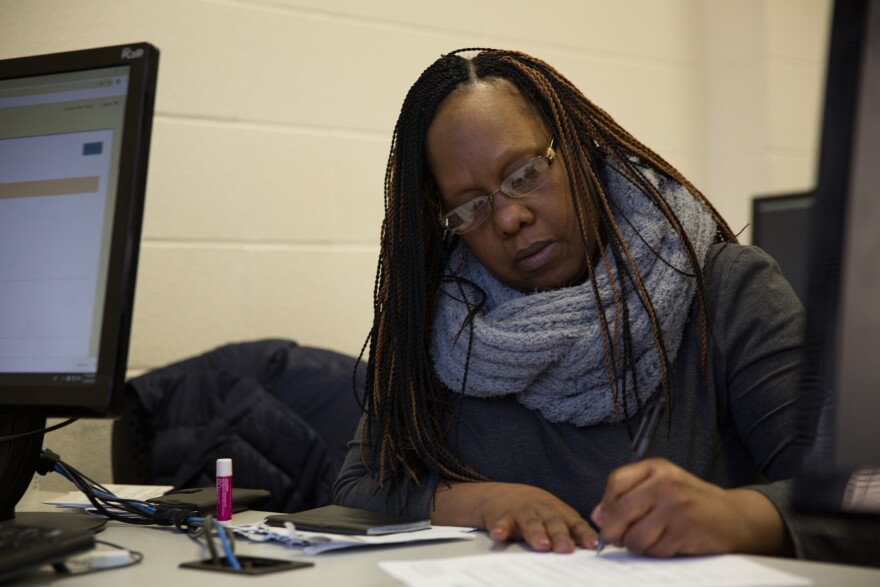

“Oh my goodness, I am floored with the taxes this year,” said Carlene Davis, a Manchester resident.

Davis had her taxes prepared at a Volunteer Income Tax Assistance site at Manchester Community College put on by a nonprofit called The Village. Last year, she received a $2,300 federal refund.

This year? $500.

Davis hadn’t paid attention throughout the year to the amount of money in her paycheck withheld for taxes: if you’re paying less in taxes throughout the year, you’re likely to get less in your refund check.

“I’ve been hearing about the new tax laws and how they changed and how everybody’s been affected by it,” Davis said. “So I was all nonchalant saying 'OK -- it’s a couple of hundreds, whatever.’ I come here today and boy did I see a significant difference – I was like, ‘Oh my goodness -- I can’t believe it.’”

The surprise stems from the 2017 tax cuts that were signed into law in 2017 by President Donald Trump. Many workers are being taxed less on their income as a result. Those tax cuts also meant adjustments to withholding tables -- those are the formulas used to calculate how much people pay in taxes per paycheck.

That’s why people are getting less money back after filing their 2018 returns than they did in 2017.

“I’ve had some instances where people got back $5,000-$6,000 last year and this year, they got back nothing or owe a little bit,” said David Gendreau, a tax preparer in West Hartford.

Not only are some people missing out on that big refund they thought they’d be getting. But now, they may owe money if they had less money withheld from their paychecks throughout the year than the total taxes due for 2018.

Melanie Morales showed up at the VITA site in Manchester with some knowledge related to the withholding adjustments. She brought a W4 form, which is what people fill out in part to declare the rate at which tax dollars are taken out of each paycheck, so that her tax preparer can help her make a withholding decision.

“I don’t want to owe the IRS,” said Morales, who’s from Manchester. “I want to keep my money.”

Last year, Morales got a modest refund. The withholding adjustments have her feeling nervous as she awaits the verdict on her 2018 federal refund.

“$260 – which is not bad,” Morales said.

Morales got money back. She works one less job than she did a year ago, so she wasn’t expecting much. She’s 18 – she’s not married, she’s got no dependents, so the changes haven’t hit her as hard.

But Carlene Davis, who’s sitting two rows up from Morales, had different expectations.

“I work almost three jobs just to keep up with my rent and to pay my bills and to keep [being] medically healthy,” Davis said. “My premium is more than what I’m getting back in my tax returns.”

She came in to her tax prep session with hopes of having money to pay for some credit card debt. Also, if there was enough refund money left over, she could go on vacation. Instead, she’s left with questions on how to update her withholding allowance.

People may run into other surprises along the way of filing their 2018 tax returns. Deduction caps are further compromising tax refunds. People aren’t benefiting from itemized deductions -- things like property taxes, mortgage interest, and charitable donations that lower your taxable income -- like they did a year ago.

“There was no caps on the taxes, so the numbers were like $40,000 and they could claim all of it whereas this year they can only claim $10,000 of it,” said Gendreau, the tax preparer.

The best thing you can do to avoid this type of surprise – according to Gendreau – is hire an accountant to spell all of this out for you. It’s too late for 2018 – but you can update your withholding formula for next year, and get a sense of where you stand with deductions.

Some people do have more money in their pockets because of the tax cuts – which is great if you’re expecting it – but the changes to withholding and deduction rules mean there’s some pain along the way.